Advisory Board

The Kosciusko County Advisory Board is made up of a group of individuals in the community who come together for the common purpose of administering to the needs of law enforcement and detention in our community. The persons on the board go further by committing resources and cooperation with Community Corrections to better the lives of the individuals we serve.

2023 COMMUNITY CORRECTIONS ADVISORY BOARD

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Beacon

Custodial Parents

The following services are available:

- locating a parent

-

establishing paternity, including genetic testing.

-

establishing, modifying and enforcing a court order for child support.

View the available list of Forms for Parents and Employers

Circuit Court

I'm a Veteran

Countless benefits & resources are available to you as a reward for your faithful service. Kosciusko County VSO can help you understand and access your benefits and guide you through the process of applications, claims and appeals.

Drainage Board

-

DRAINAGE BOARD MEMBERS:

- CARY GRONINGER - CHAIRMAN................................(574) 527-6665

- JIM SCOTT - VICE CHAIRMAN......................................(574) 268-8205

- STEVE METZGER - MEMBER.........................................(260) 609-7818

- DENNIS DARR - MEMBER.............................................(260) 457-3033

- JOE IRWIN - MEMBER....................................................(260) 527-6637

- SANDY ANGEL - SECRETARY.........................................(574) 265-2620

- EMAIL: [email protected]

DRAINAGE BOARD MEETINGS FOR 2024

January 25 - CANCELLEDContact the Surveyor's Office for more information: (574) 265-2620

Minutes for each Drainage Board Meeting are available in the Surveyor's Office upon request.

Adult Protective Services

ADULT PROTECTIVE SERVICES

Adult Protective Services investigates reports of potential neglect, self-neglect, battery, and exploitation in anyone who may be an endangered adult as defined by Indiana statute 12-10-3-2 (if he/she is: 18 years of age or older and unable to protect themselves due to being mentally or physically disabled, or frail elderly, from being battered, neglected, exploited, or self-neglected) and, where substantiated, finds the least restrictive intervention to resolve the situation. They also provide educational opportunities for service providers and community organizations about adult endangerment, prevention and response.

Adult Protective Services consists of investigators that cover Kosciusko County and three other counties consisting of Marshall, Elkhart, and St. Joseph. Kosciusko County Adult Protective Services recovers funding from the state but is under the direct supervision of the Kosciusko County Prosecuting Attorney.

If a vulnerable adult is in immediate danger, dial 9-1-1 or call the police immediately!

|

Duty to Report Endangered Adults

An individual who believes or has reason to believe that another individual is an endangered adult and is the victim of battery, abuse, or exploitation is required by law to make a report to law enforcement or Adult Protective Services.

Immunity from Civil Liability for a Person Making a Report or Testifying

A person who in good faith makes a report of an endangered adult, or testifies at administrative or judicial proceedings on matters arising from the report, is immune from both civil and criminal liability for doing so and an employer may not reduce benefits or otherwise retaliate against them.

Signs of An Endangered Adult:

- Not allowing the dependent person to talk or see visitors.

- Indifference or anger toward the dependent person.

- Aggressive behavior (threats, insults, harassment, etc.).

- Conflicting accounts of incidents.

- Withholding affection.

- History of substance abuse, mental illness, criminal behavior, or family violence.

Financial Abuse Indicators:

- Unusual or inappropriate activity in bank accounts.

- Refusal to spend money on dependent person for health care of personal items.

- Numerous unpaid bills.

- Living environment not comparable with income.

- Missing furniture, silverware, jewelry, etc.

- A recent will when elder seems incapable of writing a will.

Physical Indicators:

- Soiled clothing or bed.

- Dehydration or malnutrition.

- Frequent use of emergency room or hospital.

- Cuts, lacerations, puncture wounds.

- Any injury inconsistent with history.

- Bruises on the upper arms or in the shape of object.

- Presence of old and new bruises at the same time.

- Injury that has not been cared for.

- Cigarette burns.

- Lack of necessities in the home, such as water, food, and medicine.

Behavioral Indicators:

- Confusion or disorientation.

- Denial, unlikely stories.

- Fear, withdrawal, non-responsive, hesitation to talk openly, helplessness, depression, agitation, anxiety, and anger.

Adult Protective Services will investigate all calls made and protect those who are determined to be endangered.

Job Postings

Benefits for all Full-Time Positions

- 12 paid holidays & 2 floating holidays

- Personal/sick time - 1/2 day a month starting at the 7th month

- Vacation after one year of employment

- Health insurance including, medical, dental and vision at 1st of month after 60 days

- County paid life insurance

- Retirement plan

Resource Navigator (Jail Chemical Abuse Program-JCAP) - Sheriff

Full-Time - 40 hours

Starting Wage: $23.83

Responsibilities:

- Meet one-on-one with Kosciusko County Recovery Program (KCRP) participants and determine needs.

- Talk with inmates regarding interest in the program and work with them to fill out participation form.

- Meet with participants weekly to discuss needs and give resources.

- Connect participants to resources.

- Schedule upcoming doctor/dentist appointments with Bowen Health Clinic.

- Responsible for the Release Plan for participants.

- Assign a Peer Recovery Coach with each KCRP participant upon release.

- Responsible to make sure release packets are put in participant's property bag.

- Respond to inquiries from family members, attorneys, and members of the public regarding KCRP, visitation, and status of individual detainees.

- Enforce local, state, and federal laws by implementing effective policy to protect the lives and property of the people.

- Collaborate with community agencies, members, and organizations.

- Be familiar with area resources.

- Maintain updated progress reports.

Qualifications:

- High school diploma/GED

- Associates Degree or higher in related field preferred.

- One (1) year of experience assisting underserved populations or individuals.

- Possession of substance abuse qualifications or ability to complete within six (6) months the following: Trauma-Informed Care training (JU Trauma-Informed Care for Justice Involved Individuals); Suicide Preventions training (QPR); Basic jail procedure training.

- Ability to meet all employer and department hiring requirements, including passage of a drug test, background check, completion of ILEA Jail Academy, and attend annual Defensive Tactics Training.

- Possession of or ability to obtain certification from the Indiana Law Enforcement academy as a Correctional Officer.

- Possession of or ability to obtain required certifications, including First Responder/CPR, IDACS, NCIC, AED, and handgun/firearm certification.

4/12/24

Truck Driver - Highway

Full-Time - 42.4 hours

Starting Wage: $21.16

Responsibilities:

- Operate various trucks and equipment in clearing and maintaining County rods and rights-of-way, including dump truck, pay loader, front-end loader, pugmill, chipper, excavator, grader, snow plow, paver, power broom, compaction rollers and pavement recycler.

- Haul and spread road materials, including gravel, sand, top dirt, asphalt, and salt.

- Install/remove permanent and emergency road signs, and install pavement and railroad crossing markings.

- Perform preventative maintenance on trucks and equipment, including washing, maintaining fluid levels, lubricating, changing oil and tires, and record on maintenance log as required.

- Operate chain saws, mowers, and chipper in removing weeds, brush and storm-damaged trees from rights-of-way, including road sides, culverts, guard rails, and bridges.

- Lift and load pipes and guard rails, shoveling and spreading road patching materials and picking up trash.

- Periodically operate semi-trailer to haul heavy equipment to/from work sites.

- Periodically assist with flagging/traffic control at work sites, and assist in excavating ditch/drainage sites and install and repair tile and culverts as needed.

- Serve on 24-hour call for emergency situations.

- Perform other duties as assigned.

Qualifications:

- High school diploma/GED

- Must be at least 18 years of age

- Possession of a valid Indiana driver's license and a valid Commercial Driver's License (CDL) and demonstrated safe driving record.

- Ability to meet all employer and Department hiring and retention requirements, including passage of a drug test, medical exam, and not posing a direct threat to the health and safety of others in the workplace.

- Working knowledge of and ability to make practical application of safety policies and procedures and properly operate trucks, related equipment and tools, including dump truck, pay loader, pugmill, grader, front-end loader, chipper, snow plow, paver, power broom, compaction rollers, pavement recycler, chain saw, cutting torch, welding equipment, shovel rake, pruner, and various hand tools.

- Working knowledge of and ability to physically and safely perform assigned duties which may involve sitting and/or standing/walking for long periods, heavy lifting, carrying and pushing/pulling objects, reaching, bending, and grasping objects.

- Ability to work with or be exposed to violent/irate individuals and respond to situations involving potential physical harm to self and others.

- Ability to occasionally work extended hours, evenings and weekends, and travel out of town, but not overnight, to obtain equipment.

- Ability to serve on 24-hour call and respond swiftly, rationally and decisively to emergency situations.

4/9/24

Tattoo, Nail, Piercing, Public Pool Specialist - Health Department

Part-Time - 25-29 hours, flexible

Starting Wage: To be determined

Responsibilities:

- Inspect tattoo, nail, piercing and public pool establishments. Review potential health violations and hazards, collect samples, take photographs, advise personnel on proper sanitation of equipment and other necessary procedures, and take appropriate action to ensure compliance with all requirements.

- Investigate and resolve sanitation and other complaints, including take samples, assist with resolution and complete follow-up procedures to ensure continued compliance with all regulations.

- Ensure resolution of code violations, including notify regulating agencies and facilitate enforcement procedures as necessary.

- Respond to reported illness and discuss with establishment owners.

- Use computer to file and maintain various records, including inspection scores, code violations and reviews

- Review construction/equipment plans for tattoo, nail, piercing and public pool establishments and conduct periodic inspections during construction/remodeling to ensure continued compliance.

Qualifications:

- Bachelor's degree in business, health care, public health or related field.

- Possession of or ability to obtain certification required within time period specified by Department.

- Ability to pass a drug test.

- Thorough knowledge of federal, state and local rules and regulations.

3/14/24

Health First Indiana (HFI) Secretary - Health Department

Part-Time - 25-29 hours, flexible

Starting Wage: $18.87

Responsibilities:

- Answer telephone, respond to inquiries, take messages or transfer to appropriate department or individual.

- Greet and assist visitors, including assist with various grant applications.

- Perform various clerical tasks, such as prepare letters, emails, documents and reports.

- Take, type and distribute minutes on a timely basis.

- Represent HFI on various committees and organizations.

- Perform computer data entry and queries, including timely and accurate submission of HFI Core Public Health Tracker data.

- Collect statistics regarding HFI, prepare and submit reports.

- Organize marketing program for HFI and Kosciusko County Health Department.

- Prepare and maintain spreadsheet of HFI data and financial matters.

Qualifications:

- High school diploma/GED

- Ability to meet all employer and department hiring requirements, including passage of a drug test.

- Working knowledge of and ability to make practical application of state and local rules, regulations and procedures regarding HFI.

- Ability to effectively communicate orally and in writing with co-workers, other County departments, medical offices, social service agencies, school nurse, and the public, including being sensitive to professional ethics, gender, cultural diversities and disabilities.

- Ability to compare, observe, evaluate and classify data, and file, post, and mail materials.

- Possession of a valid Indiana driver's license and demonstrated safe driving record.

3/13/24

Registrar IV - Health Department

Full-Time - 8:00 AM - 4:30 PM, Monday - Friday

Starting Wage: $18.87

Responsibilities:

- Answer telephone, respond to inquiries, take messages or transfer to appropriate department or individual.

- Greet and assist office visitors, including assist with various applications, issue birth and death certificates and letters of non-objection, receive payments and provide receipts.

- Perform computer data entry and queries, including various permit data, inspections, reports, vital records and immunizations.

- Type, file, retrieve and copy various documents as assigned, including permits, birth and death certificates, correspondence and reports.

- Perform related duties as assigned.

Qualifications:

- High school diploma/GED required.

- Possession of or ability to obtain certifications by the State Department of Health Vital Records Department.

- Ability to meet all hiring requirements, including passage of a drug test.

- Working knowledge of and ability to make practical application of state and local rules, regulations and procedures regarding vital records, including processing, filing, certifying and releasing information.

- Ability to provide public access to or maintain confidentiality of department information/records according to stat requirements.

- Ability to effectively communicate orally and in writing with co-workers, other County departments, Indiana State Department of Health (ISDH), medical offices, and the public, including being sensitive to professional ethics, gender, cultural diversities and disabilities.

- Possession of a valid Indiana driver's license and demonstrated safe driving record.

2/23/24

PT Registered Nurse for the Immunization Clinic - K21 Building

Hours will vary

Starting Wage: $23.61

Responsibilities:

- Assist with vaccine clinics administering vaccines

- Assist with lead testing

- Ability to be back up coordinator when needed

2/23/24

PT 4-H Summer Help - Extension Office

Work from late May through early August

Starting Wage - $15.00

Responsibilities:

- Committed and dedicated to young people and their growth in all areas.

- Follow all 4_H guidelines and policies of the Purdue University Cooperative Extension Service and Indiana 4-H Program in Kosciusko County.

- Promote favorable public relations and image for the 4-H program.

- Work directly under the supervision of the Purdue Extension Educators, the 4-H Administrative Assistant and 4-H Program Assistant.

- Assist with clerical, organizational, and educational responsibilities.

- Work a full-time week consisting of 37.5 hours, late May through early August.

- Commit to work all hours as scheduled the week before, during and following the Kosciusko County Community Fair, which is July 7-13, 2024.

Qualifications:

- A willingness to become familiar with and work within the philosophy and guidelines of the Purdue University Cooperative Extension Service and Indiana 4-H Program of Kosciusko County.

- A sincere interest in sharing knowledge and skills related to 4-H and youth development in an educational setting.

- The ability to work and communicate effectively in both verbal and written forms.

- Experience with the 4-H program as a youth member or adult volunteer is preferred but not required.

- Ability to pass a drug screen.

- College experience preferred.

2/8/24

Executive Director - Soil and Water Conservation District (SWCD)

Full-Time - 8:00 AM - 4:00 PM, Monday -Friday

Starting Wage: $26.20

Responsibilities:

- Supervise and direct assigned personnel which includes interviewing, hiring/termination decisions, planning, delegating, establishing performance goals, training, evaluations, providing corrective instruction and maintain discipline. Review staff timesheets and prepare time reports.

- Coordinate reviews and updates of agency business plans, plan of work and assigned related tasks.

- Serve as SWCD liaison to local, state, and federal farm bill, state programs, meeting technical specifications, federal/state deadlines.

- Serve as grant writer and administrator. Supervise staff for implementation. Track progress on grant projects ensuring tasks are completed and documented, and reports are submitted in timely manner. Prepare financial reports for grants, contracts, and agreements.

- Provide program assistance and information as needed to county, state, and federal partners for collaborative projects.

- Administer annual state Clean Water Indiana (CWI) grant for district operations, as well as CWI training support program for SWCD supervisor training.

- Maintain Share Point entries documenting program assistance for state analysis and other required district information, ensuring they are current and accurate.

- Complete and submit forms required by Indiana district law for state analysis including but not limited to, supervisor election and appointment forms, delegate forms, and annual meeting forms.

- Serve as the department Chief Financial/Fiscal Officer.

- Perform department bookkeeping and computerized accounting operations, including entering information in ledgers, preparing bank deposits, writing receipts, and paying claims.

- Monitor department investments, certificates of deposits, saving plan, and checking account. Prepare year-end reconciliation of bank statements and financial reports for Indiana State Board of Accounts and SWCD board meetings.

- Prepare quarterly tax reports for supervisors and monthly sale tax reports.

- Develop budgets for operating special emphasis projects and grants.

- Coordinate the preparation of the annual county budget for SWCD.

Qualifications:

- Bachelor degree in business, agriculture, natural resource management or closely related field, or equivalent combination of education and previous related experience is required.

- Ability to meet all employer and department hiring requirements, including passage of a drug test.

- Ability to pass federal USDA background check to receive authorities, access to federal computers, USDA programs, and communications.

- Ability to attain E Authorization certification form USDA to assist with programs.

- Ability to pass state training certification and follow state protocols for workplace harassment.

- Ability to pass federal training certification and follow federal protocols for protection of federal program information.

- Working knowledge and/or ability to make practical application of agriculture, natural resources, and local, state, and federal conservation laws and guidelines.

1/31/24

Maintenance Technician

Full-Time - Mon - Fri, 7:00 AM - 4:00 PM

Part-Time - 25 hours per week

Starting Wage: $23.89+ Depending on experience

Responsibilities:

- Perform general maintenance duties, including, but not limited to, raising flag, unlocking doors, turning on lights, hanging/removing signs, and preparing designated rooms for special meetings as scheduled. Assist with office renovation, demolition, clean up, furniture assembly, and moving offices.

- Maintain HVAC system, including but not limited to, change air filters, ensure proper upkeep of heating/cooling equipment such as maintain boiler and chiller equipment, service fan coils, change belts, heating and cooling valves, and motor replacement, and monitor system, assisted by Metasys system.

- Perform plumbing maintenance, including repairing water leaks, unclogging drains, and installing fixtures. Install and maintain Jail electronic and pneumatic plumbing and lift stations.

- Perform electrical maintenance to County buildings, fixtures, and equipment including testing circuits to locate problems and replacing equipment such as switches, outlets, and ballasts. Install LED upgrades. Perform diagnostics for electrical relay.

- Maintain sidewalks and grounds, including operating tractors for snow removal and yard maintenance.

- Maintain and service laundry equipment and commercial kitchen equipment, including but not limited to, dishwashers, garbage disposals, and steam kettle.

- Maintain serviceability of equipment and tools, notify Administrator of need for replacement of supplies, order supplies, and assist with putting away supplies when necessary.

- Diagnose and repair Jail pneumatic lock systems and jail door relays. Repair Jail window glass.

- Maintain and continually update all department repair and maintenance files. Prepare related reports required for Jail logs as well as air handler maintenance logs.

- Operate various tools and equipment.

- Perform walkthroughs with vendors prior to estimate process.

- Respond to emergencies on a 24-hour basis while on call.

Qualifications:

- High school diploma/GED

- Minimum of two years of related maintenance experience required. Jail maintenance is preferred.

- Ability to meet all employer and department hiring requirements, including passage of a drug test.

- Thorough knowledge of carpentry, plumbing, electrical, masonry, painting, heating and cooling systems, with ability to effectively determine County buildings repair and maintenance needs.

- Thorough knowledge of Jail maintenance and plumbing systems, including pneumatic lock systems, door relays, electronic pneumatic plumbing and lift stations.

- Working knowledge of applicable safety practices, and regulations, with ability to evaluate work projects and procedures, take proper precautions, and instruct Department employees accordingly to ensure safety of self, co-workers, County personnel and visitors.

- Ability to properly and safely operate tools and equipment.

- Ability to perform physical requirements of the position, including exposure to wet and icy conditions, working near chemicals, fumes, odors, dust, and dirt, and sitting and walking at will, standing/walking for long periods, lifting/carrying under 75 pounds, bending, crouching/kneeling, reaching, handling/grasping/carrying objects, pushing/pulling objects, far and close vision and hearing sounds/communication.

- Ability to occasionally work extended, evening, and/or weekend hours.

- Ability to respond to emergencies on a 24-hour basis.

- Possession of a valid Indiana driver's license and demonstrated safe driving record.

1/17/24

Merit Deputy - Sheriff's Office

Full-Time - 12-hour shift

Starting Wage: $28.35

Responsibilities:

- Enforce local and state laws by implementing effective policy for the prevention and investigation of crimes to protect the lives and property of the people.

- Regularly patrol all roads within the County and other designated areas, ensuring the security of residences and businesses, investigate and report suspicious or unlawful activities, and perform necessary actions to ensure the proper enforcement of applicable laws.

- Monitor radio and other communication devices and respond to citizens' calls of distress and complaints of alleged unlawful activity. Assess and bring situations under control and take statements from victims and witnesses. Provide appropriate assistance and unsure the lawful apprehension and arrest of criminal offenders as required by law.

- Perform vehicle stops, including checking for proper licensing and registration, enforce traffic laws and speed limits, issue warnings and/or citations, administer roadside sobriety tests as necessary, and effect arrests as warranted.

- Respond to and investigate traffic accidents. Assess extent of personal injuries, request emergency assistance, aid the injured, regulate and direct traffic, escort emergency vehicles and assist stranded motorists. Tag and dispose of abandoned vehicles as needed.

- Pursue suspect in vehicle and/or on foot, subdue and arrest suspects, advise of constitutional rights, search suspects/arrestees, seize weapons and/or contraband, and transport to detention facility.

- Respond to residential and business alarms, investigate potential unlawful activity and initiate appropriate action to properly enforce applicable laws and/or protect the lives and property of the public.

- Investigate misdemeanors and felony complaints for crimes against people, animals and/or property and missing persons. Investigate illegal possession, distribution, and sale of controlled substances.

- Maintain knowledge of criminal activities in the area.

- Secure, protect, and document crime scenes. Collect and preserve evidence, maintain chain of custody of evidence. Locate witnesses of criminal activities, interview and/or interrogate witnesses/suspects, and protect and/or counsel victims and witnesses.

- Conduct searches of both persons and property with and without a warrant in accordance with the law.

- Prepare and submit to superiors all required reports and summaries of activities according to established Department deadlines.

- Inspect condition of assigned vehicle and equipment and maintain uniform in a neat and professional manner.

- Maintain confidentiality and security of information/cases.

- Serve on 24-hour call for emergencies and respond to emergencies from an off-duty status.

Qualifications:

- High school diploma/GED

- Must be at least 21 years of age.

- Completion of Indiana Law Enforcement Academy for law enforcement officers. Possession of or ability to obtain handgun/firearm certification by the Indiana Law Enforcement Academy.

- Possession of or ability to obtain/retain First Aid and CPR certification.

- Ability to meet all Departmental hiring and retention requirements, including passage of a drug screen and written, medical, and psychological exams.

- Thorough knowledge of and ability to make practical application of the customary practices, procedures, rules and regulations of the Department, to perform standardized patrol operations and take authoritative action as situations demand.

- Thorough knowledge of community geography and police jurisdiction/boundaries, and working knowledge of local, state, and federal laws.

- Working knowledge of and ability to use all assigned Department equipment and weapons, including but not limited to computer, keyboard, camera, vehicle, radio, binoculars, breathalyzer, rifle, handgun, shotgun, and handcuffs.

- Working knowledge of radio frequencies, codes, procedures, and limitations.

- Ability to work extended, irregular, evening, and/or weekend hours, and occasionally travel out of town for training, surveillance or transports, sometimes overnight.

- Possession of a valid Indiana driver's license and demonstrated safe driving record.

8/11/23

Caseworker - Title IV-D

Full-Time - 37.5 hours - 8:00 AM - 4:30 PM (Monday-Friday)

Starting Wage: $20.31

Responsibilities:

- Responsible for investigating, establishing and enforcing child support obligations.

- Interview and assist AFDC and Medicaid recipients and Title IV-D service applicants in preparation for enforcement action, including explaining Title IV-D policies and procedures, completing applications and forms.

- Prepare/dictate various documents for establishing and enforcing child support and filings in court, such as correspondence, pleadings, petitions, and summons, and file documents accordingly, including conducting research and investigations.

- Prepare cases for court hearings, and calculate child support delinquencies and orders according to state guidelines.

- Respond to telephone and office inquiries regarding Title IV-D policies and procedures, and resolve problems related to individual cases.

- Maintain communication with various agencies and individuals in obtaining information and resolving problems, including state and county welfare departments, attorneys, caseworkers, absent parents, clerk of child support and other child support enforcement offices. Perform necessary follow-up.

- Periodically communicate with laboratory in scheduling genetic tests.

- Periodically attend and participate in training sessions and seminars.

Qualifications:

- High school diploma/GED

- Two (2) years of experience in a child support related area preferred.

- Must complete ISETS and ICE training.

- Must be able to pass a drug test.

- Basic knowledge of and ability to make practical application of Title IV-D policies and procedures, county court system and related legal terminology and requirements.

- Ability to provide public access to or maintain confidentiality of department information and records according to state requirements.

8/11/23

Housekeeper

Part-Time, Monday - Friday, 5-hour shift based on availability - hours are flexible

Starting Wage: $17.28

Responsibilities:

- Clean offices, meeting rooms, courtrooms, hallways, stairwells, entrances and elevators, including emptying trash cans, cleaning table tops, dusting, cleaning and polishing furniture, upholstery, walls, doors and woodwork, blinds, windows and window sills.

- Clean and disinfect bathrooms

- Vacuum, sweep, mop and dust

Qualifications:

- High school diploma/GED

- Pre-employment drug screen and background check

- Able to stay on task and work independently

- Ability to work near chemicals, fumes, odors, dust and dirt

- Ability to stand for long periods of time, lifting/carrying under 25 lbs, bending, crouching/kneeling, reaching, handling/grasping/carrying objects and pushing/pulling.

8/11/23

Work Release Officer

Full-Time - 40 hours - Varying schedule

Starting Wage: $21.52

Responsibilities:

- Enforce local, state and federal laws by implementing effective policy to protect the lives and property of the people.

- Check inmates in and out of facility to be released for work, give breathalyzer tests, and search for weapons and other contraband when returning to the facility. Perform weekly comparison of inmates work hours and time spent out of facility.

- Drive inmates to bank and court. Maintain contact with inmates utilizing Sunday pass.

- Dispense prescribed medications and maintain accurate medication logs.

- Perform booking procedures for new inmates, including performing drug test, assigning room, and logging personal information into master file.

- Maintain accurate files and paperwork, including medical and medication logs, room assignments, and master file.

- Monitor inmates' activities and behaviors, ensure compliance with facility rules and regulations, and report all unusual and/or unruly activity to appropriate supervisor.

- Regularly inspect facility, ensuring security and monitoring the general health and welfare condition of inmates, and ensuring cleanliness and security of cell areas. Regularly search rooms, checking for illegal content, weapons, or other contraband.

- Answer telephone and greet jail office visitors, determine nature of call, respond to inquiries regarding detainee of the facility and/or route caller to appropriate person or department.

- Maintain inventory of supplies, ordering when needed.

- Make copies of inmate check stubs to ensure rent is paid and determine weekly fees.

- Perform related duties as assigned.

Qualifications:

- High School diploma or GED

- Ability to meet all employer and Departmental hiring requirements, including passage of a drug screen.

- Working knowledge of and ability to use all assigned Department equipment, including computer, breathalyzer, and drug/narcotic identification kit.

- Ability to perform essential functions of the position without posing a direct threat to the health and safety of self and other individuals in the workplace.

- Ability to provide public access to or maintain confidentiality of department information and records according to state requirements.

- Ability to work irregular, extended, evening, and/or weekend hours.

- Possession of a valid Indiana driver's license and demonstrated safe driving record.

1/6/23

Confinement Officer - (Jailer)

Full Time - 40 hours - Schedule Varies

Starting Wage: $23.83

Responsibilities:

- Serve as Jail Officer for the Kosciusko County Jail, responsible for maintaining security and order within the facility.

Qualifications:

- Enforce local, state and federal laws by implementing effective policy to protect the lives and property of the people.

- Maintain interior and exterior security of jail facility, including monitoring surveillance cameras, operating electronic and digital door controls, monitoring activities of detainees, and conducting patrols. Maintain accurate accounting of all detainees, including conducting periodic cell checks, roll calls, head counts of detainees in assigned areas and opening and closing of cell block doors.

- Perform booking procedures of individuals being detained, including photographing, fingerprinting, entering required information on the computer, completing required forms and intake reports, receiving and receipting money and personal property, and searching detainees for weapons and contraband. Register sex offenders.

- Perform bonding procedures by completing required forms, receiving and receipting bond money, writing check to Clerk of the Courts, returning personal belongings and releasing detainee.

- Oversee detainee in allowable activities, such as telephone calls, commissary purchases, counsel, and family visitations. Distribute daily meals and ensure all trays are removed from cellblocks. Ensure personal hygiene of detainees and cleanliness of cell areas, accounting for all cleaning supplies and equipment issued to detainees.

- Provide detainees with prescribed medications according to orders of physician. Follow department procedures to ensure detainees receive proper medical attention.

- Ensure compliance with facility rules and regulations, record and report inappropriate behavior to appropriate department personnel, and take appropriate action to correct any problems that arise. Properly secure and/or physically restrain violent and uncontrollable detainees as situations demand.

- Transport and/or escort individuals detained by the County to various locations including court, Department of Corrections, or medical facilities and hospitals, appointments, recreation, library and other meeting activities.

- Supervise and direct daily activities of Trustees, including making work assignment and assuring proper accomplishments of duties.

- Respond to inquiries from family members, attorneys and members of the general public regarding visitation and status of individual detainees.

- Respond to detainee grievances following established chain of command procedures.

- Maintain and update institution logs, incident reports, daily activity reports, booking/release records and medical records. Submit all reports and summaries of activities according to established Department deadlines.

- Receive, sort and log incoming and outgoing mail and personal items for detainees as required.

1/6/23

Drug Court

The mission of the Kosciusko County Drug Court program is to offer a sentencing alternative for offenders addicted to, or abusing illicit drugs through a multi-disciplinary and collaborative intensive rehabilitative services approach. Drug Court works through service providers to reduce use of and demand for illicit drugs.

Fees included for participation:

- Initial Fee: $100.00 (one-time)

- Monthly Fee: $50.00/month (recurring)

- Drug Screen Fee: $20.00 per drug screen

Board of Finance

Bad Checks

A Message From

Prosecuting Attorney Daniel H. Hampton

As your Prosecuting Attorney, naturally I am always concerned about the negative impact of bad checks passed to local businesses. Millions of dollars are lost nationally by merchants as a result of this ongoing problem. Bad checks affect everyone in terms of higher consumer costs that must be passed on to offset losses, and increased taxes to cover the additional costs for law enforcement and prosecution.

In an effort to combat this problem, I have organized the Bad Check Recovery Program to assist local merchants with bad check losses. The primary goal of the program is to obtain full restitution for the victim without adding to the financial burden of the criminal justice system. Also, to assist you in reducing your risk in accepting a bad check or to determine whether your bad check is eligible for the Bad Check Recovery Program, you should review the acceptance tips and program eligibility form.

Your interest and participation in this special program will benefit all law-abiding citizens and help your business improve its bottom line!

Bad Check Recovery Program

6 EASY STEPS

2. Complete the bad check crime report form . Attach the original check(s) or bank-generated substitute check and the notice from the banking institution indicating the reason that the check was dishonored to the completed form. You MUST retain photocopies of all check(s) submitted and notification documents, such as return receipts and bank notices. Also, you should remember that whenever you inquire about the status of this check(s) with the Prosecutors Office, you must refer to the check number and maker's name.

3. Mail the completed bad check crime report form with the attachments described in step #2 above to:

4. Once the check(s) has been sent to our office, in the event that the maker of the check should contact you, you MUST direct that person to our office immediately. DO NOT accept payments. The Prosecuting Attorney's Office collects a fee for Kosciusko County which you will be responsible to pay if you collect from the maker.

5. In the event we procure payment from the maker of the check, we will mail the payment by way of money order to the address you provided on the bad check crime report. The money order will contain the amount of the check plus a $25.00 service fee.

6. The Prosecuting Attorneys Office mails a recovery notice to the maker of the check on the Thursday following the receipt of the check submitted by you. If you have not received a payment from the Prosecuting Attorneys Office within 17 days following that Thursday mailing, you must contact the Bad Check Recovery Administrator, 372-2419, to discuss criminal prosecution against the maker.

Original Government Survey Field Notes

I'm Active Duty, National Guard or a Reservist

Still serving? Thinking about getting out or retiring? Are you serving in National Guard or Reserves and not sure what benefits you're eligible for? Check out the resources for transitioning service members and those currently serving.

- National Guard/Reserve Benefits

- Transitioning Servicemembers

- VA Healthcare & Enhanced Eligibility

- VA Health Benefits

- Mental Health Care

- Records / DD214 / Medical Records

- Veteran ID Cards

- Education & Careers

- Education & Training Benefits

- Education Benefits Overview Guide

- VR&E

- Career Counseling

- Employment Services

-

- Work One Region 2 - Northern Indiana

- Kelly Griffin - Disabled Veteran Outreach Program Specialist - [email protected] 574-229-7590

- Daniel Reed - Disabled Veteran Outreach Program Specialist - [email protected] 574-370-0670

- Trellus Washington - Local Veterans Employment Representative - [email protected] 574-524-6148

- Operation: Job Ready Veterans

- Deborah Ryan, Community Outreach Director (317) 450-1796, [email protected]

- IDVA Employment Assistance

- Career Counseling

- Work One Region 2 - Northern Indiana

- Support for Vet-Owned Small Businesses

- Pre-Discharge Disability Compensation Claims

- Service-Connected Disability

- Home Loans/Disability Housing Grants

- Retirees

- Life Insurance

- License Plates

- Crisis Support & Resources

- Veterans Crisis Line

- 1-800-273-8255 then Press 1; 24 hours per day/7 days per week/365 days per year

- Legal Assistance

- 1-844-243-8570; Monday - Friday, 10:00 a.m. - 2:00 p.m. EST

- Homeless Veterans

- 1-877-4AID-VET (1-877-424-3838)

- Military Family Relief Fund

- Veterans Crisis Line

- Indiana State Veteran Benefits

- Indy Vet Center

- Recreational Benefits

- Property Tax Deduction

- Sign Up for Indiana Vet Connect!

- Veterans Pension

- Aid & Attendance

- Pension Benefits Summary

- Pre-need Eligibility for Burial in a VA National Cemetery

Superior Court 1

The court was established in 1969 and is currently resided over by the Honorable Karin McGrath, Judge.

Employers

Candidate and Ballot Information

Drug Testing Information

Drug Screen Phone: 800-494-1250

Drug Screen website: drugchecktest.com

- In the even that the system could not be reached or was busy, you must continue checking the system until you are successful or use drugchecktest.com. Failure to check-in will be tracked in the system as a missed test.

- Drug Testing Hours:

- Monday - Friday: 10:00am to 11:00am OR 2:45pm to 3:45pm

- Saturday and Sunday: 10:00am - If you show up after 10:00am, it will be considered a POSITIVE test.

- Holidays: 10:00am - If you show up after 10:00am, it will be considered a POSITIVE test.

Demand Notices

Demand Notices - Personal Property and Mobile Homes

Each year after the May tax payment deadline, personal properties and mobile homes that are delinquent from the prior year will be subject to a $5 demand fee. If not paid within 60 days from the date of the demand, the demand will become a certified judgment to the Kosciusko County Clerk of the Courts. After the demand fee is attached to the property, the payment is turned over to American Financial Credit Services and an additional percentage collection fee is added. After certification payments must be made to American Financial Credit Services, 10333 N Meridian St., Suite 270, Indianapolis, IN 46290 Phone 1-888-317-2327. Daily interest will be applied.

Please call the Kosciusko County Treasurer's Office at 574-372-2370.

I'm related to/caring for a Veteran

Caring for those who have served is its own kind of service to our country. Learn more about benefits you may be entitled to for your service. Kosciusko County VSO can provide you further assistance with questions, applications or claims when you are ready.

- Benefits for Family Members

- Caregiver Assistance Stipend

- Caregiver Support & Resources

- Healthcare for Family & Caregivers

- Assisted Living/Home Healthcare/Nursing Home

- Indiana State Tuition

- Life Insurance

- Veterans Pension

- Aid & Attendance

- Pension Benefits Summary

- Pre-need Eligibility for Burial in a VA National Cemetery

- VA Home Loans

- Education Benefits

- Employment Resources

- Work One Region 2 - Northern Indiana

- Kelly Griffin - Disabled Veteran Outreach Program Specialist - [email protected] 574-229-7590

- Daniel Reed - Disabled Veteran Outreach Program Specialist - [email protected] 574-370-0670

- Trellus Washington - Local Veterans Employment Representative - [email protected] 574-524-6148

- Operation: Job Ready Veterans

- Deborah Ryan, Community Outreach Director (317) 450-1796, [email protected]

- IDVA Employment Assistance

- Career Counseling

- Work One Region 2 - Northern Indiana

Interstate Child Support

The Federal Government, all the states, and many countries have established a uniform set of laws governing how to handle child support cases when the parents do not live in the same state or country. The rules are technical and complex. If you have a question about an case where multiple states are involved and one of the parties lives in Kosciusko County, or the Order is from Kosciusko County, please reach out to us. [email protected]

If you need other assistance related to child support, please use one of these forms:

Lake-Level Data

AVAILABLE IN THE OFFICE

Established legal lake level elevations, base flood elevations (lakes and streams), USGS water resource data, DNR geodetic control data (sea level bench marks), FEMA flood hazard boundary maps, and Tippecanoe River elevations.

Fee Schedule

KOSCIUSKO COUNTY RECORDER

100 W. CENTER ST. ROOM 203

WARSAW, IN 46580

574-372-2360

MORTGAGE 55.00

ALL OTHER DOCUMENTS 25.00

*Including UCC filings

*Fee includes 1 oversized page and 1 mailing for Mechanic’s Liens

Additional pages exceeding 8.5” x14” 5.00

Each additional mailing (Mechanic’s Liens) 2.00

COPY FEES

Page not exceeding 11”x 17” 1.00

Page exceeding 11”x17” 5.00

Certification 5.00

Child Support

J. Brad Voelz, Prosecuting Attorney

The Kosciusko Child Support Enforcement Office is a division of the Kosciusko Prosecuting Attorney's Office.

Introduction

In 1975, Congress enacted legislation under the Social Security Act (Title IV-D) to require the states to establish programs to establish paternity and establish and collect child support orders for both AFDC (Aid to Families with Dependent Children) and non-AFDC cases. The State of Indiana contracts with local county prosecutor's offices to provide these services. In addition to paternity duties and establishing and enforcing child support, this office also establishes orders for health insurance where appropriate and regularly deals with other issues related to child support such as modification of support, emancipation questions, locating absent parents, review and adjustment of support orders, support in foster care cases, collection of medical reimbursement for parents and criminal felony nonsupport cases.

Establishment and Enforcement Tools

Delinquent child support may be enforced either through civil administrative remedies, civil judicial remedies or, last but not least, criminal charges for Nonsupport of a Dependent Child.

Civil Administrative Actions

Paternity can be established through a Paternity Affidavit. Once certain time periods have passed, the affidavit has the same effect as a judicial finding of paternity and can be enforced as such. In a child support action, pursuant to Indiana law, the Court is required to issue an immediate Income Withholding Order to collect child support. Therefore, every case must have an Income Withholding Order to take the support out of the person's pay, unless the Court makes certain findings of fact, including a finding that it is in the best interest of the child for income withholding not to occur. Almost all cases have income withholding and once child support has been established, child support caseworkers directly issue Income Withholding Orders to the employer of a payor, without going through the Court System. Through the Indiana State Child Support Computer Network, the child support caseworkers automatically implement various enforcement tools such as interception of tax refunds, interception of lottery winnings, unemployment withholding, and denial of passport applications, implementation of automobile liens and reporting of delinquencies to the credit bureau.

Judicial Remedies

Paternity can also be established by the filing of a paternity action in Court. The parties are given the chance to have a DNA test and if paternity is established, the Court may order the payment of reimbursement for Past Public Assistance to the State of Indiana, establish a current child support order that is made retroactive to the date of the filing of the Petition for Paternity, establish a health insurance order and deal with such issues as custody, visitation, name change, etc. The State of Indiana is, of course, only involved in those issues related to child support.

In situations where paternity is not an issue, then child support may be established through the filing of a Petition for Support. If a child support order has already been issued, a Petition to Modify Support may be filed in order to change said support. In Indiana, support continues until the child reaches the age of 21 years. Prior to that time, the support can only be changed by court order upon application of either party.

Child Support may be enforced through the judicial remedy of Contempt of Court. If a delinquent payor is found to be in contempt for failure to pay support, the Court may order the person to serve time in the Monroe County Jail, require the person to do Road Crew, or use any other sanctions within the Court's powers. In addition, if the delinquency meets certain criteria, the Court must suspend the driver's license of the person. However, the license suspension may be placed on hold on condition that the person complies with the child support order in the future.

Criminal Nonsupport of a Dependent Child

According to Indiana Code 35-46-1-5, it is a Class D Felony if a person fails to support a dependent child. The crime is elevated to a Class C felony if the support delinquency is over $15,000. The child support division files and prosecutes cases of Nonsupport of a Dependent Child on a regular basis. The sentence in such cases depends on the facts of that particular case; however, defendants are normally placed on probation under detailed terms, including, of course, the requirement that they pay current support as well as an amount toward the support arrearage. If a Defendant fails to abide by the terms of probation, that defendant may serve time in the Monroe County Jail or the Indiana Department of Corrections.

Application for Services

TANF (Temporary Aid to Needy Families) recipients do not need to file an application since part of the TANF procedure is an assignment of support rights to the State of Indiana. TANF cases are opened automatically through an interface with the Office of Family and Children and persons involved will be contacted. Recipients of Child Medicaid or Hoosier Healthwise may be referred if they so desire at the time of application for those benefits. Other persons wishing to use the child support services must fill out an application which is available here: Link to Application

If you need assistance from the Child Support Division, please complete one of these forms:

Custodial Parent Child Support Action request

Non-Custodial Parent Child Support Request Form

Superior Court 2

The court was established in 1976 and is currently resided over by The Honorable Torrey Bauer, Judge, commenced his term on January 1, 2015.

Employee Information

This page contains information for current employees of Kosciusko County Government.

Want to schedule an appointment at the employee clinic, here is a link to the scheduling software.

Medical Administrator: Auxiant www.auxiant.com

Network: Cigna www.cigna.com

Prescription: True Rx www.truerx.com

PERF: www.in.gov/inprs update address and beneficiaries

Below are medical related notices that, as an employer, Kosciusko County Government is required to provide the information to all employees. ALL OF THIS CAN BE ACCESSED ON EMPLOYEE NAVIGATOR.

Superior Court 3

The court was established in 1997 and is currently resided over by the Honorable Chad M. Miner, Judge, commenced his term on January 1, 2021.

Non-Custodial Parents

Child Support Program services are for both parents-Whether or not the child resides with you or not. Even if you pay support, you can apply for services, or ask to modify child support already ordered. By working closely with the Prosecutor's Office, a person who pays child support can avoid or minimize issues that may arise regarding their child support case and/or child support payments.

Applications for service are available from the State of Indiana Link to Application. Completed Applications must be brought to your initial meeting with our office.

Under Indiana law, parents ordered to pay support are required to pay their court-ordered child support on time and in full. If you cannot meet the full obligation or cannot make the court-ordered payments contact this office as soon as possible to avoid or minimize any adverse actions that may be taken.

View and print the available list of Forms for Parents and Employers

If you need assistance, please use on of these forms:

Facebook Page

Personal Property

Personal property taxes are levied against all tangible personal property used in a trade or business, used for the production of income, or held as an investment that should be or is subject to depreciation for federal income tax purposes including but not limited to mobile homes (not on permanent foundations), billboards, and materials for use in production. Inventory is no longer taxed.

Downloadable Personal Property Forms

- Form102 Farmer's Tangible Personal Property Assessment Return

- Form 103 Short Business Tangible Personal Property Return

- Form 103 Long Business Tangible Personal Property Assessment Return

- Form 104 Business Tangible Personal Property Return (Cover Page)

- Form 106 Schedule of Adjustments to Business Tangible Personal Property Return

For additional Personal Property Forms Click Here

Map & Geographic Data

The following are available in the County Surveyor's Office:

AERIAL PHOTOGRAPHS FOR THE FOLLOWING YEARS

- 1938

- 1951

- 1957

- 1965

- 1974

- 1981

- 1985

- 1991 & 1992

- 1996

- 2002

- 2005

- 2008

Mobile Home Transfers

MOBILE HOME TITLE TRANSFER

Permits are required for all transfers and moving of mobile homes.

If the mobile home is no longer owned by the person listed on the assessment notice, the owner must bring the mobile home title to the County Treasurer's Office and apply for a Mobile Home Title Transfer Permit. All property tax must be paid to obtain the permit including property taxes assessed to previous owners.

MOBILE HOME TITLE TRANSFER

LOST TITLE

FAILURE TO PAY MOBILE HOME TAX DEMAND NOTICES/JUDGMENTS/PAYMENTS TO AFCS

Infraction Deferral Program

INFRACTION DEFERRAL PROGRAM

The Traffic Infraction Deferral Program is offered through the Kosciusko County Prosecutor's Office. It is available to qualified drivers for the dual purposes of promoting safe driving and allowing the driver to avoid any additional points on his/her driving record through the Bureau of Motor Vehicles (BMV).

You may qualify to participate in the traffic infraction Deferral program if you:

- do NOT hold a commercial driver's license (CDL)

- If you are an out-of-state driver, you must provide us with a copy of your current State driving record with your completed Infraction Deferral Agreement

- Received only one ticket (if 2 or more tickets, must get prosecutor's approval)

- Were 18 years of age or older at the time the ticket was received

-

Were not going more than 25 mph over the posted speed limit

-

Were not going more that 15 mph over within a 45mph zone on U.S.30

- Were not speeding in a work zone or a school zone

- Received a ticket which is approved for the program

- The most common types of tickets that qualify are:

- Speeding up to 25 mph over the posted speed limit (not in school zone or work zone and not in a special speed zone on U.S.30)

- Disregarding a traffic light or a stop sign or a yield sign (not on U.S. 30)

- Following too closely

- Driving left of center

- Unsafe lane movement

- NOT an offense involving an accident, passing a school bus, failing to yield to an emergency vehicle, no insurance, or any other eight-point offense (as designated by the Indiana Bureau of Motor Vehicles)

Eligibility is at the complete discretion of the Kosciusko County Prosecutor. Any driver may be made ineligible for any reason by the Kosciusko County Prosecuting Attorney.

The Staff of the Prosecutor's Office will review your ticket to determine if you are eligible. If you are eligible, you will receive information on enrolling in the program.

To participate in the Infraction Deferral Program, you may come in person to the Kosciusko County Clerk's Office, 121 N. Lake St., Warsaw, IN 46580 from 8:30AM - 4:00 PM. Bring the Deferral Form and the fee identified by the Prosecutor's Office in the form of cash, cashier's check, certified check, or money order made payable to the Clerk of Kosciusko County. You do this instead of paying the ticket (i.e. do not pay the ticket and then bring in the deferral form). The effective date of this agreement will be the date the Clerk of Kosciusko County receives the signed agreement and the payment. If you comply with the terms of deferral agreement then you will not accumulate any additional points on your BMV driving record. If you fail to comply with any of the terms of the agreement, the ticket may be re-filed with the Court. If that happens the deferral fee is forfeited and you will need to either pay the ticket, or contest it.

To participate in the Infraction Deferral Program by mail, you may complete the documents sent to you and return them to the Clerk of the Court.

Receipts are not automatically sent out, so in order to receive verification of your payment, you must include a self-addressed stamped envelope with your payment and a receipt will be returned to you.

The deadline to participate in the Infraction Deferral Program is the due date on the ticket, also referred to as the court appearance date. Therefore, you must come in person to the Kosciusko County Clerk's Office OR mail the signed agreement and fee on or before the due date.

If you have a question that has not been addressed above, you may call the prosecutor's office at (574) 372-2419. Have your ticket handy when you call.

I'm a Survivor/Next of Kin (My Veteran has passed away)

The loss of a Veteran is a loss shared by a grateful nation. Learn more about benefits to memorialize and commemorate your Veteran's service, as well as Survivor Benefits to which you might be entitled (eligibility requirements differ).

- VA Burial Benefits Guide

- Burial in VA National Cemetery

- Burial Allowances

- Federal VA Burial Allowance

- Kosciusko County offers a $100 county burial allowance reimbursement and/or an $100 allowance to offset the cost of setting of the headstone/marker. The Funeral Home will typically fill this out with next-of-kin. If they do not, or if you need to file for one further down the road, contact us.

- Free Government Headstone, Marker or Medallion

- Memorialization & Certificates

- Burial Honors

- Obtaining DD214/discharge certificate

- Assisting Families with Burial for Veterans

- Bereavement Counseling

- Survivor Benefits

- Survivor Benefits Overview

- Family/Survivor Healthcare Benefits

- DIC (Compensation Related to Service-Connected Disability)

- Accrued Benefits (Substitution of Claimant for pending Claim/Appeal)

- Survivors Pension

- Aid & Attendance

- Surviving Spouse Property Tax Deduction

- Dependent & Survivor Education Benefits

- Life Insurance Benefits

- Helpful Resources

Online Images

Superior Court 4

The court was established as of July 1, 2019 and is currently resided over by The Honorable Christopher D. Kehler, commenced his term on July 1, 2019.

Return to County Clerk

FAQ's

- How soon before my sentencing date do I need to turn in my application?

- In order to have your application received and interview process completed, you sould submit your application at least 2 - 3 weeks in advance.

- Where can I get an application?

- Applications can be picked up at the Community Corrections office, located at 121 N Lake Street, Warsaw or downloaded here.

- What if I am sentenced in one case but have pending cases?

- You must be fully sentenced in all cases before beginning your time on home detention.

- How do I pay my fees for my home detention?

- Home Detention fees can be paid by cash, cashiers check or money order in person at the office located at 121 N Lake Street, Warsaw or at PAY HERE.

- How much money do I need to start Home Detention?

- If you live in Kosciusko County, are going to serve a Kosciusko County sentence, and have been accepted into the Home Detention program, it is $400.00 to begin. If you are transferring your case to another county, it is $250.00 to transfer to another county.

- I am currently on the Home Detention program but I can not get into contact with my officer at this time. What do I do?

- You should call the emergency hotline/on-call number at (574) 265-5484.

Pre-Trial Diversion Program

What is the Pre-trial Diversion Program (PDP)?

The Pre-trial Diversion Program (PDP) is a program offered at the discretion of the Kosciusko County Prosecutor's Office. It may be offered to defendants without significant prior criminal records who have been charged with certain offenses. The program requires a defendant to complete a specific set of requirements, and, upon successful completion, the defendant's charges will be dismissed.

What charges are eligible for PDP?

Certain misdemeanor offenses including (but not limited to) Illegal Consumption or Possession of an Alcoholic Beverage, Public Intoxication, Possession of Marijuana and Check Deception may be considered for participation in the Pre-trial Diversion Program. Not all people charged with the same crime may be found eligible for the program. Regardless of the charges filed, eligibility for PDP is not guaranteed and is determined on a case-by-case basis.

How do I apply for PDP?

If you wish to see if you are eligible for the Pretrial Diversion Program, you may download the Pretrial Diversion Program form . All previous charges, arrests, diversions and convictions must be reported on the Pretrial Diversion Program Form. Failure to do so will result in the case being ineligible or being immediately terminated from diversion. Once you fill out the form, forward it to the Prosecutor's Office either by email at [email protected] or by fax 574.372.2470, or by mail at

Kosciusko County Prosecuting Attorneys Office

PDP Administrator

121 N. Lake St.

Warsaw, IN 46580

The Prosecutor staff reviews each report and considers, among other things, the charges involved, the circumstances surrounding the incident and the defendant's prior criminal history to determine if a case is appropriate to be offered PDP.

How do I know if I am accepted into PDP?

After submitting the Pretrial Diversion Program form, the Prosecutor staff will review your form along with other considerations. If you qualify the PDP contract will be offered to you at your pre-trial hearing.

Do I need to show up for my initial court date?

Yes. The staff from the Kosciusko County Prosecutor's Office may not speak with a defendant prior to him/her appearing in court and being advised and understanding their Constitutional Rights. A defendant may contact a defense attorney prior to appearing in court. At the initial hearing, the defendant will appear before the Judge and enters a plea of either "guilty" or "not guilty." If a defendant pleads "guilty", then a conviction will be entered on his/her record and he/she will be sentenced accordingly. If a defendant pleads "not guilty," then the case will be set for a pre-trial conference and a trial date. The defendant may receive a court appointed attorney (if one is requested) or may hire a private attorney, and the case will continue in court. Any time after the initial hearing and prior to the pre-trial conference, the defendant may apply for PDP.

How much does PDP cost/What do I have to do for PDP?

The costs and fees associated with PDP vary depending on the requirements a defendant must complete for the program. Requirements are determined based on the charges filed, circumstances of the case and the defendant's prior criminal background. Requirements differ, based on the offense charged, and may include, but are not limited to, counseling (alcohol/anger management), random drug screening, no contact order, community service, restitution or proof of a valid driver's license. The defendant is responsible for any costs associated with these requirements. These costs are not included in the Pretrial Diversion fee.

What happens if I am unsuccessful in completing the requirements of PDP?

If you fail to comply with any of the terms or requirements of the Pretrial Diversion Program, the Prosecuting Attorneys Office may reinstate the original charge with the Court. If this happens, the Diversion fee and all other program fees will be forfeited and you will need to appear at the next scheduled Court hearing to either plead guilty or indicate your desire for a trial date to be scheduled.

I don't live in Kosciusko County. Can I still do PDP?

Most often, yes. It is not uncommon for PDP defendants to need to try and complete their PDP requirements outside of Kosciusko County, Indiana. PDP staff will try to assist defendants who are eligible and willing to do PDP. It does, however, become chiefly the defendant's responsibility to work out where and how he/she will complete the requirements, and he/she must verify with PDP staff before completing requirements that everything is satisfactory.

Will PDP keep this incident totally off of my record?

PDP is designed to help a defendant keep a criminal conviction off his/her record with regard to the offense charged. If he/she successfully completes the program, the court record will show that the charge was dismissed. The benefit of PDP is that there is no criminal conviction and the defendant does not plead guilty. When asked if he/she has ever been convicted of or plead guilty to a criminal offense, a defendant may answer "no" with regard to the charge in a successfully completed PDP case. However, a record that an arrest occurred, or that the charge was filed in court, will not be expunged or erased. Police records of an arrest or citation are beyond the control of the Prosecutor's Office. If a defendant is asked if he/she has ever been charged with a criminal offense, he/she must always answer "Yes." Upon successful completion of the program, a defendant may specify that the charge was dismissed. In that case, when a background check is run the court record will show that an order of conditional dismissal was issued and the case was closed.

Payment Options

PAY IN PERSON AT COURTHOUSE

OUTSIDE DROP BOX

PAY BY MAIL

SPRING PAYMENTS

PAYING SPRING AND FALL IN THE SPRING

FALL PAYMENTS

ISSUING CHECKS FROM YOUR BANK BILL PAY ACCOUNT

PAY AT PARTICIPATING BANKS

Property Tax Assessment BOA

Once a taxpayer has filed written notice of appeal, the local official is statutorily required to forward that written notice to the county PTABOA, which will hear the taxpayer's appeal and issue a written determination. A board of county commissioners may determine whether to have a 3 or 5 member PTABOA. The county assessor is a non-voting member of the PTABOA regardless of the number of members. In a county with a 5 member PTABOA, the commissioners appoint 3 freehold members and the county council appoints 2 members. In a county with a 3 member PTABOA, the county council will appoint 1 individual and the commissioners will appoint 2 freehold members so that not more than 2 of the members of the entire board may be of the same political party. Additionally, at least 2 of the members must be residents of the county.

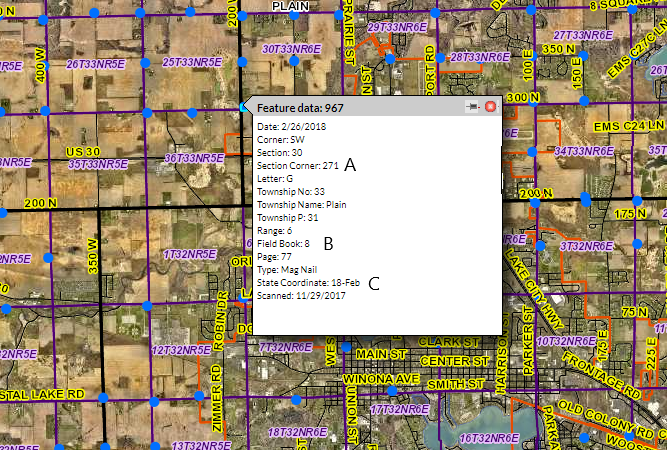

Section Corners on Beacon Web Site

Section Corners are currently being updated and maintained on the Beacon website. These are being updated in conjunction with the Section Corner Book, the State Coordinates, and the Field Books as the Section Corners are located. Instruction on accessing this information is listed below.

Above is an example of Section Corner data as displayed on the Beacon website.

A: This is the Section Corner Book Page. By clicking on "Section Corner Book" under Topics of Interest, you can then choose the correct township and find the corresponding page within the PDF

B: This is the Field Book and Field Book Page number. By clicking on "Section Corner Field Books" under Topics of Interest, you can choose the correct field book and find the corresponding page within the PDF

C: This is the date (if available) that GPS coordinates were taken of this section corner. If a date is available, click on "Section Corner State Coordinates" under Topics of Interest and find the corresponding date and Section Corner within the PDF.

Note: Section Corner data is periodically reviewed and may not be completely up-to-date. Furthermore, the icons are not in the exact location of the section corners. They are offset slightly. Additional Section Corner information is available in the County Surveyor's Office.

Notice of Appeal

To File a Notice of Appeal, please contact the PROPER Court and Court Reporter:

Teen Court

Teen Court is a court for teens conducted by their peers. It is an alternative to the juvenile court system for teens who have committed specific types of non-violent misdemeanors or school infractions and it is based on the concept of restorative justice. Restorative justice seeks to hold the offender accountable to repair the damage done by his or her offense and address the cause of the offense rather than simply punish the offender.

In Teen Court, student volunteers act in various roles in the courtroom including as prosecuting and defense attorneys and as members of a peer jury. The teen court helps set individualized sanctions for each offender in hopes of repairing relationships in the community and providing resources to improve future decision making. In return for volunteering their time, the student volunteers learn about the judicial process and community resources and can gain new perspectives and develop useful analytical and communication skills.

Property Tax Info & Forms

KOSCIUSKO COUNTY TAX BILLS

Property taxes in Kosciusko County will be due May 10, 2024 and November 12, 2024. Payments may be made in person at the Treasurer's Office located in the Courthouse at 100 W Center Street, 2nd Floor Warsaw, In 46580. There is a ground level entrance on the west side of the Courthouse with access to the elevator to take taxpayers to the second floor. A drop box for payments is also available during the Spring and Fall tax collections on the West side of the old Courthouse at the handicapped entrance.

Payment options are cash, check or money order. Debit and credit cards are taken in the office but require an additional convenience fee.

If payments are mailed, they should be sent to Kosciusko County Treasurer, PO Box 1764, Warsaw, IN 46581. Spring payments must be postmarked by May 10, 2024. Fall payments must be postmarked by November 12, 2024. If you are mailing your payment on the due date we strongly suggest that you take the envelope inside the post office and have it hand cancelled. Payments received with a post mark after due dates are subject to penalties.

Taxes may be paid at all Lake City Bank branches, with the original tax bill and no prior delinquencies.

Taxpayers with questions about their tax bills may contact the Kosciusko County Treasurer's Office at 1-574-372-2370.

Victims Assistance

VICTIM ASSISTANCE PROGRAM

It is the responsibility of our office to defend the rights of crime victims. Our mission is to assist crime victims through the, often daunting maze, of the criminal justice system. Upon your request, we will keep you informed of the status of your case, seek your input before disposition of the case, pursue restitution and assist you in locating and obtaining help from community resources and social service agencies.

1914 Atlas of Kosciusko County

Upcoming Events

- April Drainage Board Meeting04/25/249:00 am - End

- County Commissioners Meeting05/06/249:00 am - End

- Solid Waste Board Meeting05/06/2411:00 am - End

- Election Day - CLOSED05/07/24 All Day

- KCCRVC Meeting & Budget Review05/08/249:00 am - End

In this Department

Topics of Interest

Contact Us

Contact Us

Warsaw, IN 46580

Contact Us

Warsaw, IN 46580

Contact Us

Warsaw, IN 46580

- Phone: (574) 267-5667

- Fax:

(574) 372-3255 - Staff Directory

Contact Us

Warsaw, IN 46580

- Phone: (574) 372-2304

- Staff Directory

- Hours: 8:00am - 4:30pm

Visit us in Room 303

Contact Us

Assessor

Warsaw, IN 46580

- Phone: (574) 372-2310

- Fax:

(574) 372-2469 - Staff Directory

- Hours: Monday-Friday

8:00 AM to 4:30 PM

Closed for Legal Holidays

Contact Us

County Auditor

Warsaw, IN 46580

- Phone: (574) 372-2323

- Staff Directory

- Hours: Monday thru Friday

8:00 am to 4:30 pm

Room 220

Contact Us

County Clerk

Warsaw, IN 46580

Contact Us

Warsaw, IN 46580

Contact Us

Contact Us

GIS Director

- Phone: (574) 372-2485

- Fax:

(574) 372-2476 - Staff Directory

- Hours: 8:00 am - 4:30 pm

Contact Us

Warsaw, IN 46580

- Phone: (574) 372-2349

- Fax:

(574) 269-2023 - Staff Directory

Contact Us

Warsaw, IN 46582

- Phone: (574) 372-2356

- Fax:

(574) 372-2357 - Staff Directory

- Hours: Normal office hours are from 7:00 a.m. to 4:00 p.m. - Monday through Friday.

Contact Us

Warsaw, IN 46580

- Phone: (574) 265-2668

- Fax:

(574) 372-2476 - Staff Directory

Contact Us

Warsaw, IN 46580

Contact Us

Chief Probation Officer

Warsaw, IN 46580

- Phone: (574) 372-2412

- Fax:

(574) 372-2438 - Staff Directory

- Hours: Monday:

8:00 am until 7:00 pm

Tuesday through Friday:

8:00 am until 4:00 pm

Contact Us

Warsaw, IN 46580

Contact Us

- Phone: (574) 372-2360

- Staff Directory

- Hours: 8:00 AM-4:30 PM Monday-Friday

Contact Us

Warsaw, IN 46580

Contact Us

Warsaw, IN 46582

- Phone: (574) 267-7445 x 5372

- Fax:

(574) 269-2875 - Staff Directory

Contact Us

Kosciusko County Surveyor

Warsaw, IN 46580

- Phone: (574) 372-2366

- Fax:

(574) 372-2369 - Staff Directory

- Hours: 8:00am-4:30pm (Office located on the ground floor of the Historical Courthouse)

Contact Us

Treasurer

Warsaw, IN 46580

- Phone: (574) 372-2370

- Staff Directory

- Hours: 8 AM to 4:30 PM Monday thru Friday

Closed for Legal Holidays

Contact Us

Warsaw, IN 46580

- Phone: (574) 372-2436

- Staff Directory

- Hours: Monday, Tuesday, Thursday & Friday

8:00AM - 12:00PM & 1pm-4pm (Appointments only) Wednesday

8:30am - 12pm & 1pm - 3:30PM (Walk-ins Welcome)

Contact Us

Warsaw, IN 46580

- Phone: (574) 372-2425

- Fax:

(574) 372-2428 - Staff Directory

- Hours: 8:00 am to 4:30 pm

Monday - Friday

Contact Us

Assessor

Warsaw, IN 46580

- Phone: (574) 372-2379

- Fax:

(574) 372-2469 - Staff Directory

- Hours: Monday-Friday

8:00 AM to 4:30PM

Closed for Legal Holidays

Contact Us

Assessor

Warsaw, IN 46580

- Phone: (574) 372-2310

- Staff Directory

- Hours: Monday-Friday

8:00 AM to 4:30 PM

Closed for Legal Holidays

Contact Us

Contact Us

Warsaw, IN 46580

- Phone: (574) 372-2425

- Fax:

(574) 372-2428 - Staff Directory

- Hours: 8:00 am to 4:30 pm

Monday - Friday

Contact Us

- Staff Directory

- Hours: 8:00 am to 4:30 pm

Contact Us

Warsaw, IN 46580

- Phone: (574) 372-2360

- Fax:

(574) 372-2469 - Staff Directory

- Hours: 8:00 AM-4:30 PM

Monday-Friday

Contact Us

Contact Us

Warsaw, IN 46580